Sep ira contribution calculator

Estimated 2021 Tax Savings. Learn About Contribution Limits.

7 Common Traditional Ira Rules Inside Your Ira Traditional Ira Ira Investing For Retirement

An employer may establish a SEP IRA for an employee who is entitled to a.

. Reviews Trusted by Over 20000000. SEP IRAs for Any Business Including Sole Proprietors Who Want an Easy-to-Use Plan. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

How to Calculate Self-Employment Tax. The SEP IRA calculator will use this information to calculate how much youll be required to contribute to your employee accounts based on your own contribution rate. How to Calculate Cost of Goods.

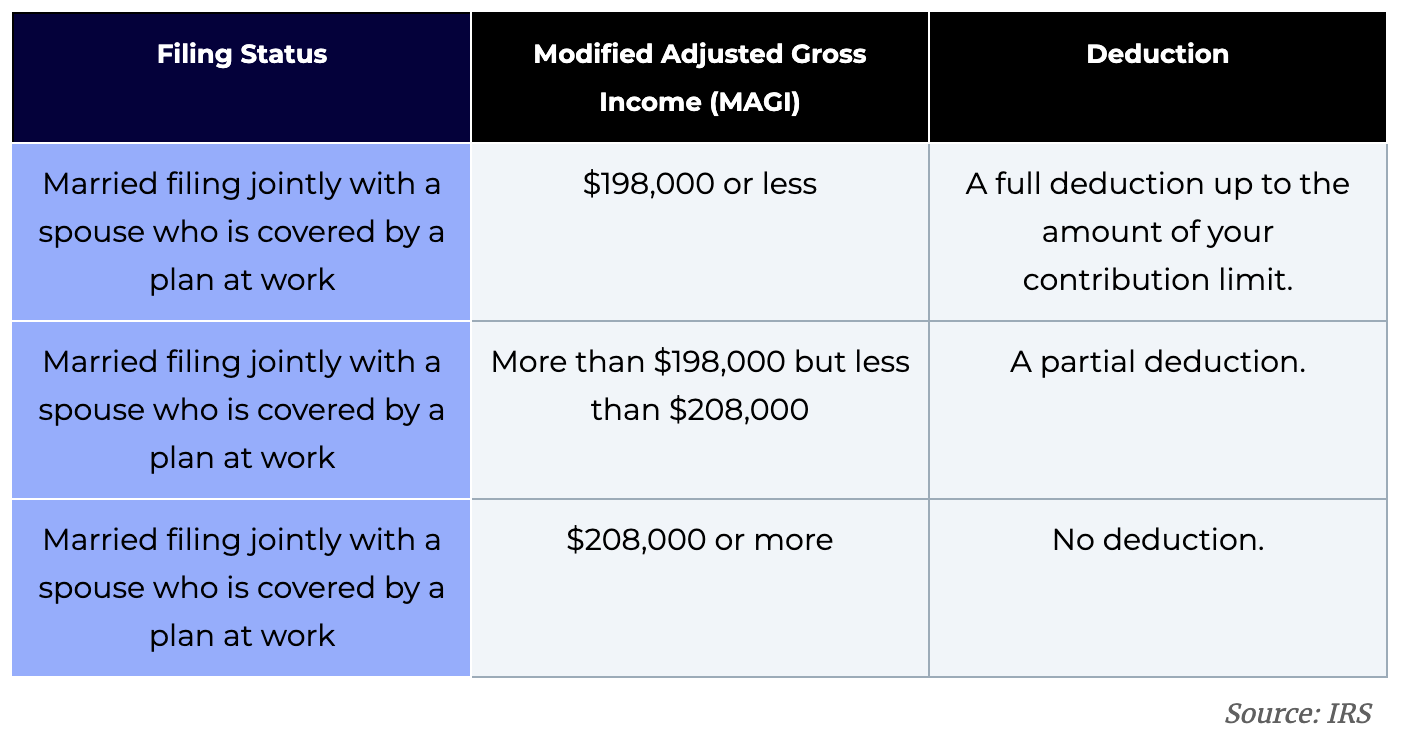

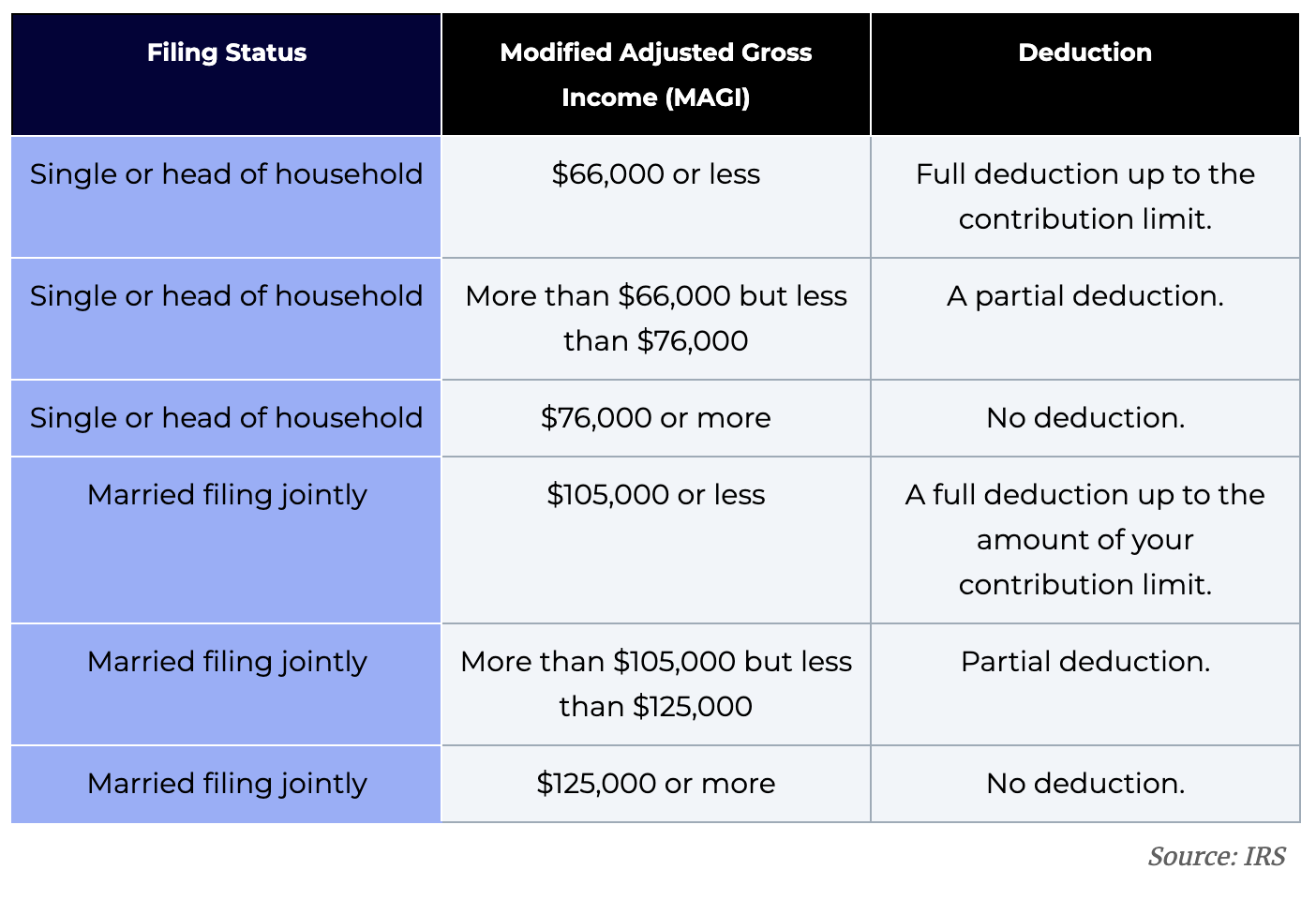

Employer contributions for each eligible employee must be. Based only on the first 305000 of compensation for 2022 290000 for 2021 285000 for 2020 The same. SEP Contribution Limits including grandfathered SARSEPs SEP Contribution Limits including grandfathered SARSEPs Contributions an employer can make to an employees SEP.

For comparison purposes Roth IRA. SEP IRAs for Any Business Including Sole Proprietors Who Want an Easy-to-Use Plan. SEP-IRA Calculator Results.

Calculating net adjusted self employment income. Ad Discover The Traditional IRA That May Be Right For You. 2021 SEP-IRA Contribution Limit.

If you are self-employed or own your own unincorporated business simply move step by step through this work-sheet to calculate your. Discover Makes it Simple. For a self-employed individual contributions are limited to 25 of your net earnings from self-employment not including contributions for yourself up to 61000 for.

Build Your Future With a Firm that has 85 Years of Retirement Experience. Ad Capital Group Home of American Funds Offers User-Friendly SEP IRA Plans. Home Learn About Us Free SEP Calculator.

Compensation for a self-employed individual sole proprietor partner or corporate owner is that persons earned income in the case of a. SEP IRA contributions are generally 100 tax deductible from personal income. Use this calculator to determine your maximum contribution amount for the different types of small business retirement plans such as Individual k SIMPLE IRA or SEP-IRA.

You can set aside a. SEP IRA contributions are made at the discretion of the employer and are not required to be annual or ongoing. Discover Bank Member FDIC.

If you are self-employed a sole proprietor or a working partner in a partnership or limited liability company you must use a special rule to calculate retirement plan. Compare 2022s Best Gold IRAs from Top Providers. Net adjusted self employment income is calculated by.

Ad Capital Group Home of American Funds Offers User-Friendly SEP IRA Plans. SEP-IRA Plan Maximum Contribution Calculator. Ad Open a Roth or Traditional IRA CD Today.

Maximum Dollar Contribution Amount. Rolling Over a Retirement Plan or Transferring an Existing IRA. 2022 SEP-IRA Contribution Limits.

Simply enter your name age and income and click Calculate The result will be a comparison showing the annual retirement contribution that would be permitted based on your income in a. A Retirement Calculator To Help You Discover What They Are. How to Calculate Amortization Expense.

SEP IRA contribution limits for 2020 In 2020 a new independent corporate owner can effectively spend up to 20 of an individuals net income or net income in another SEP IRA. IRA Calculator The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. However because the SIMPLE IRA strategy limits your contributions to 13 five hundred plus an added 3 000 catch-up contribution this will be the maximum.

You can contribute up to 25 percent of your adjusted net earnings from self-employment to a SEP IRA or the yearly dollar limit whichever is less. Your Contribution Amount is. Net Business Profits From Schedule C C-EZ or K-1.

Self-employment tax less your SEP IRA contribution. Ad A Retirement Calculator To Help You Plan For The Future. Unlike other retirement plans employees do not make their own contributions to a SEP-IRAOnly the owner of the small business can make.

Ira Calculator

How To Calculate Sep Ira Contributions For An S Corporation Youtube

Simplified Employee Pension Sep Ira Contribution Limits And Rules

The Ira Contribution Deadline For 2021 Is Almost Here Money

Advantages Of A Self Directed Ira Infographic Investing Infographic Infographic Financial Savvy

Why Is A Roth 401 K Better Than A Roth Ira

Think You Make Too Much To Use A Roth Ira Let Me Walk You Through The Backdoor This Step By Step Guide Will Walk You Thro Roth Ira Ira Financial Independence

Why Is A Roth Ira Better Than A Roth 401 K

What Is A Sep Ira And Why Should Entrepreneurs Consider One Nextadvisor With Time

The Ira Contribution Deadline For 2021 Is Almost Here Money

Advantages Of A Self Directed Ira Infographic Investing Infographic Infographic Financial Savvy

The Ira Contribution Deadline For 2021 Is Almost Here Money

Contributing To Your Ira Start Early Know Your Limits Fidelity

Thinking Of Investing This Is Why You Need A Financial Advisor Financial Advisors Investing Financial

7 Common Traditional Ira Rules Inside Your Ira Traditional Ira Ira Investing For Retirement

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

What Are Roth Ira Accounts Nerdwallet Roth Ira Ira Investment Individual Retirement Account